How Swimming Pool Owners Can Reap Tax Deductions

Let’s say you’re a pool owner and when thinking about tax deductions, your swimming pool is not typically the first thing that comes to mind. However, under certain circumstances, installing a swimming pool may qualify for a tax deduction. This article delves into the criteria, processes, and implications of claiming a swimming pool as a medical expense deduction on your taxes.

Latest

Want Above-Ground Pools in Virginia? What to Look out For

What You Should Know About Fiberglass Pools

Categories

The Basics of Medical Expense Deductions

In a recent discussion with Wall Street Journal tax reporter Laura Saunders, a reporter for the Wall Street Journal, a wealth of information was uncovered about how taxpayers can leverage their medical expenses to reduce their tax bills significantly.

To understand the deduction for swimming pools, one must first grasp the concept of medical expense deductions. The IRS allows taxpayers to deduct unreimbursed medical expenses that exceed 7.5% of their adjusted gross income. These expenses include payments for the diagnosis, cure, mitigation, treatment, or prevention of disease, and for treatments affecting any part or function of the body.

Swimming Pools as a Deductible Medical Expense

In the interview, Laura Saunders talks about how a taxpayer can leverage their swimming pool for tax deductions. She says, in rare instances, swimming pools can qualify as a medical expense. The key factor is that the primary purpose of the pool must be for medical care, as prescribed by a physician. For example, if a doctor recommends aquatic therapy to treat a chronic condition like arthritis, the costs of installing a pool may be partially deductible.

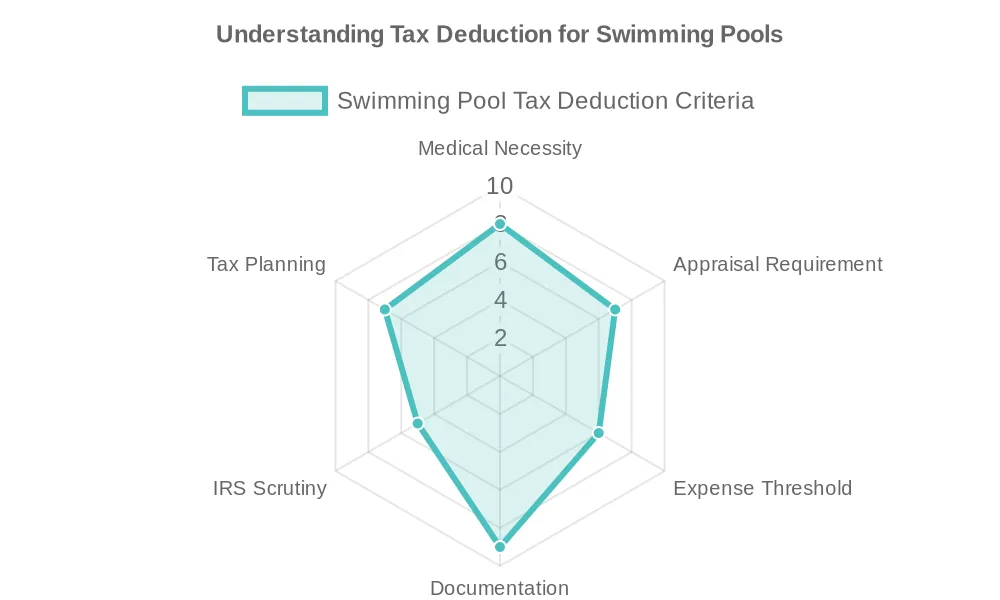

Criteria for Deductibility

- Medical Necessity: There must be a clear medical justification for the swimming pool to qualify for tax deductions. This often requires a doctor’s prescription or letter stating that the pool is necessary for treating a specific medical condition.

- Appraisal Requirement: To deduct the cost of the pool, you must have your property appraised before and after the pool installation. The increase in property value due to the pool is subtracted from the deductible amount.

- Exceeding the Threshold: The total medical expenses, including the cost of the pool after adjusting for the increase in home value, must exceed 7.5% of your adjusted gross income.

Case Studies and Real-Life Examples

Let’s consider a hypothetical case. John, suffering from severe arthritis, is advised by his doctor to undergo regular aquatic therapy. Based on this medical advice, John installs a swimming pool in his backyard. The pool costs $50,000, and an appraisal reveals that it increases his home’s value by $20,000. Thus, John can consider the remaining $30,000 as a medical expense, which he can deduct if his total medical expenses exceed 7.5% of his income. Genius, right!!

Documenting the Deduction

Documentation is key. Taxpayers should keep detailed records, including:

- The doctor’s prescription or recommendation.

- Receipts for all costs associated with the pool’s construction, maintenance, and use for medical purposes.

- Appraisal reports before and after the pool installation.

Limitations and Considerations

It’s crucial to understand the limitations of this deduction:

- Not for Recreational Use: The primary purpose of the pool must be medical. If the pool is used recreationally, it may disqualify or reduce the potential deduction.

- IRS Scrutiny: Given the unusual nature of this deduction, claims involving swimming pools may attract closer scrutiny from the IRS.

Tax Planning Strategies

Taxpayers considering a pool for medical reasons should consider:

- Consulting with a tax professional to understand the implications and ensure compliance with IRS regulations.

- Discussing with their healthcare provider the necessity of a pool for medical treatment.

- Preparing for potential audits by keeping thorough documentation.

Broader Implications

While these swimming pool tax deductions are rare, they highlight the broader scope of what can be considered a medical expense. Taxpayers should be aware of the potential for swimming pool tax deductions beyond traditional medical treatments and equipment.

Conclusion

The possibility of deducting a swimming pool as a medical expense demonstrates the complexity and breadth of tax laws. While not common, this deduction can provide significant financial relief for those with specific medical needs. As with all tax matters, careful documentation, adherence to IRS guidelines, and consultation with professionals are key to successfully claiming such tax deductions.

YOU'RE NOT IN THIS ALONE

We are with you every splash of the way

Need a pool fix or looking for an upgrade? We’re just one click away to help with all your pool needs.